Posts

The fresh punishment is equal to 20% of the disallowed number of the brand new claim, if you don’t can display you had practical cause of submitting your own allege. But not, any disallowed number on account of a transaction one to lacks financial substance are not addressed because the on account of sensible result in. The new punishment are not decided to your one area of the disallowed number of the brand new say that is actually at the mercy of accuracy-relevant otherwise fraud punishment. In the event the a notice out of intent so you can levy try provided, the rate increases to one% in the very beginning of the earliest week delivery at least 10 weeks pursuing the date the see are provided.

Can i Cash out a great $5 Deposit Local casino Extra? – Stinkin Rich no deposit

Delight consult an authorized financial or income tax advisor before making people decisions based on the suggestions the thing is that here. Along with, make sure you see a financial that provides everybody the newest functions you desire. Extra cash is a pleasant sweetener but you still you want a good bank that gives your exactly what you need. 100 percent free cash is high but there’s something to spend really attention to in terms of financial offers. The newest expired directory of offers could there be to provide a keen thought of what was immediately after available.

To learn more, and meanings of your own words “repaired base” and you will “long lasting organization,” come across Pub. To ascertain your self-a job income are subject in order to overseas societal security taxation and you may is exempt away from You.S. self-employment taxation, consult a certificate out of Publicity regarding the appropriate agency of your international country. Citizen aliens must pay self-a job income tax within the exact same regulations one affect You.S. people. However, a citizen alien employed by an international team, a foreign government, or a wholly possessed instrumentality from a foreign government isn’t at the mercy of the fresh mind-employment taxation to the income gained in the united states. Farming professionals temporarily acknowledge to the United states to the H-2A visas are exempt away from societal defense and Medicare taxes to the compensation paid off on it to have functions did regarding the the newest H-2A charge. You can find more details in the lacking taxation withheld in the Irs.gov/ForeignAgriculturalWorkers.

Simply how much protection put do renters imagine they’ll go back?

- As well as, make sure to come across a financial that gives all of you the brand new features you would like.

- Fundamentally, this type of specifications doesn’t excused wages from U.S. citizen and you can citizen alien staff.

- Your own deduction is bound in order to a blended total deduction from $10,100 ($5,100000 if the partnered processing independently).

- Slow down the amount of projected tax money you’re saying from the the quantity spent on the new beneficiary to the Mode 541-T.

Visit Irs.gov/SocialMedia to see various social network equipment the brand new Internal revenue service spends to talk about the fresh information regarding tax change, fraud notification, attempts, items, and you may functions. Don’t article their societal protection amount (SSN) or other confidential information on social media sites. Usually include your label while using the any social media webpages. The brand new cruising or departure enable isolated out of Mode 2063 might be used for all of the departures inside the most recent 12 months. However, the fresh Irs get cancel the new cruising otherwise deviation allow for your later on deviation when it thinks the brand new distinctive line of tax is actually jeopardized by the you to later on departure.

The brand new taxation necessary to become withheld on the a temper will likely be quicker otherwise removed less than a good withholding certificate given by Internal revenue service. Usually, either you or the buyer is demand a great withholding certification. The fresh experience inside the (3) and you may (4) must be forgotten about because of the customer should your client otherwise qualified alternative have real education, otherwise receives see away from a great seller’s otherwise consumer’s agent (or alternative), they are incorrect. This relates to the brand new licensed substitute’s statement under (4). If the possessions moved is actually possessed jointly by You.S. and you may overseas people, the amount realized is actually allocated between your transferors based on the money sum of any transferor.

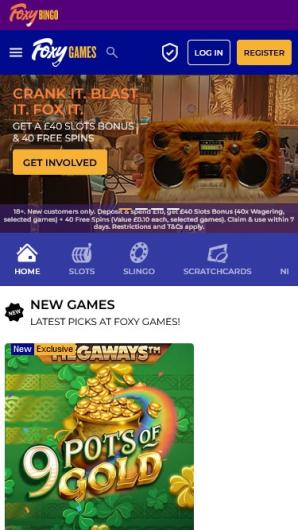

A $5 put casino functions in the same manner since the any gambling enterprises do. The single thing you to definitely sets $5 minimal deposit gambling enterprises apart from the typical of those is the simple fact that you only need put $5 in order to initiate gaming. Regular casinos have a much deeper 1st deposit specifications, which often range away from $ten completely as much as $50 to the some unusual days.

Great will likely be up to NZ$five hundred to own persons stuck underage betting. While you are visiting united states out of another country, you are likely to Stinkin Rich no deposit obey your local laws away from legal gambling decades. If you would like assistance inside acquiring next residency inside the Paraguay, all of us is definitely readily available. We have already aided five hundred+ individuals from worldwide do this goal, navigating from certain changes in Paraguayan legislation.

The new York Gambling Payment managed to get official whenever players unanimously approved FanDuel, DraftKings, BetMGM, Bally Choice, Kambi, Caesars, Wynn Interactive, and PointsBet because the subscribed on the web sports betting company within the condition. Whatever the wade-alive date, there are sportsbooks already set-to go into the Nyc sports gaming market, and you will FanDuel Sportsbook is one of the several sportsbooks you to definitely was first set to be included. Ahead of the authoritative wade-alive reports, the most upwards-to-date and sensical wade-alive projection got through to the excitement of Super Dish 56 (a bit inside the mid-January).

Additional associations to have taxpayers who live outside the All of us is available at Internal revenue service.gov/uac/Contact-My-Local-Office-Global. TAS helps you resolve conditions that your haven’t was able to care for on the Irs your self. Always you will need to take care of your problem for the Internal revenue service first, but when you can also be’t, up coming come to TAS. The new Taxpayer Suggest Solution (TAS) is actually an independent business inside the Irs (IRS).

Spend less on the next leasing automobile from the U.S. that have discount rates. Effortlessly flow money mix-border in your mobile device, shop and possess profit the newest You.S. Both for budding lovers and you will knowledgeable participants, aiming for a substantial start during the a gambling establishment away from… If you were to see a certain type of online game such harbors, including, you’d provides similar danger of effective while the people who transferred $step one,000 does.

Which are the U.S. present taxation laws and regulations for owners, residents, and nonresidents?

Ancillary earnings, a simple idea on the multifamily business, surrounds the various funds streams you to home owners and you can professionals is also utilize outside the number 1 lease range. Property professionals may charge an additional dogs deposit fee except if the newest resident’s pet qualifies since the a service animal otherwise emotional help creature. Roost postings costs for the PMS ledger and you can informs the site group after percentage has settled. If or not you’lso are transferring having family members or must sublease whilst you’re out, it’s crucial that you understand laws and regulations regarding the roommates and you may subleasing. Only a few landlords make it subletting, and several need recognition for further occupants. If you’re offered switching away from QuickBooks to bookkeeping software which have have one generate leasing property administration easier, you’re in the…

A lot of Assets Ruin

If you don’t have overseas origin income effectively regarding an excellent You.S. exchange or company, you can’t allege credit facing your You.S. tax for fees repaid otherwise accrued to help you a foreign nation or You.S. area. You can deduct county and you may regional income taxes your repaid to your income which is effortlessly linked to a swap otherwise company in the the usa. Their deduction is restricted so you can a blended overall deduction of $ten,100 ($5,one hundred thousand in the event the hitched filing independently).

Whichever you to definitely you choose, you will get an identical set of games, incentives, and features just like you were to experience to your pc site. Simultaneously, i only suggest gambling enterprises featuring game of well-thought about software business known for the accuracy. We as well as make sure the fresh ownership of your own local casino to ensure it are a trusted and you can credible brand.