Arden Faith’s knowledgeable trust pros performs closely with folks and you can family members so you can permit the seamless execution out of a great trustor’s vision, if you are getting a consistently outstanding number of services. Arden Believe Organization have a new tradition out of supporting the dating between you and your subscribers. We become part of so it larger people make it possible for seamless delivery of the trustor’s sight. With her, we offer subscribers with a holistic method and you may formal options, providing them with satisfaction in just about any aspect of their economic lifestyle. Inside 2007, i already been a market-greater push to possess greater openness on the money outcomes for personal subscribers and you will causes for the organization of one’s Arch Personal Customer Indices. Arc try an award-winning financing contacting practice advising family members and charities around the 20 jurisdictions having possessions less than guidance out of GBP 18 billion.

Mr bet casino welcome bonus – Our very own Earliest-Give Experience Opening a take a look at High-Produce Bank account

All of us provides displayed an unmatched effort inside the dealing with durability demands. These prestigious awards try a great testament of our own vow to push important feeling and apply strong sustainability steps while in the our very own financing tips and you can monetary guidance to your customers. We are not only about immediate fundraising; we have been seriously interested in fostering enough time-label effect. Because of the producing repeat providing, donor order and you can suffered donor engagement, i let causes build, and you may develop a steady economic base you to definitely supports constant ideas. Our very own purpose is to perform a-ripple effect of self-confident transform you to definitely runs better beyond the very first donation. Inside the 2023, Bailard became a-b Corp™, recognised to have conference B Lab’s stringent standards out of verified personal and you may ecological performance, corporate openness, and you may liability.

Nonetheless they’ve advised your it’ll end up being spending their cash to reside better in the retirement as an alternative than just looking to hold on to it to leave an enthusiastic inheritance. “The bank not has to have POD from the membership term or even in the facts provided the new beneficiaries are noted someplace in the financial institution facts,” Tumin told you. “When you are in that type of sneakers, you have to work at the lending company, as you might not be capable close the newest membership or change the account until they grows up,” Tumin told you. Underneath the the new legislation, faith places are in fact limited by $step one.25 million inside FDIC visibility for each trust manager for each insured depository establishment. When you have $250,100 or reduced placed in the a financial, the brand new transform will not apply at you. FDIC insurance generally talks about $250,000 for each and every depositor, for each and every lender, inside the per membership ownership group.

Begin your own wealth excursion which have a great Citi membership.

And it’ll capture a while for millennials and Gen Zers to talk about in the largesse. The newest benefactors are mainly middle-agers, mobile a number of the nice riches of a lot accumulated on the post-The second world war economic growth and you will of stock and you may a house appreciate within the latest decades. But because of the 2039, millennials is actually anticipate in order to outpace him or her because the biggest inheritors of intergenerational wealth, all the more inserted from the Gen Z. A form of this information first appeared in CNBC’s In to the Money newsletter with Robert Frank, a weekly self-help guide to the new high-net-worth buyer and you may user.

Huge Offer has been powering suits money ways for more than 15 ages, increasing £300m for British charities. Such ways try catalysed from the ‘Champions’ – trusts and fundamentals, high-net-well worth people, companies, and public funders – which offer the newest fits financing. Normally, such Winners lead four, half a dozen or seven-figure amounts in order to Larger Provide strategies. By consolidating a new fits investment model which have strategic partnerships, digital empowerment, and you will a look closely at openness and you can enough time-identity impression, i’ve written a good platform to possess driving important public and you can ecological transform.

- Mars is the Walmart out of chocolate—an excellent multigenerational members of the family team that is ubiquitous and you will extremely common.

- As the a customer, putting your finances inside the profile you to earn more versus mediocre form your own balances can also be develop smaller.

- Unmarried filers that have revenues ranging from $20,000 and you may $thirty five,100000 be eligible for smaller efforts.

- We provide creative sustainable funding choices across all asset groups very that you may possibly align your money in what things to you.

Account

This method lets us render far more environmentally friendly and you may green ways to our very own consumers when you are boosting all of our functional results. Forbes Mentor has identified an educated brokerage membership bonuses considering the advantage’s dollars worth, financing minimums or any other qualifications criteria. We opposed also provides away from twenty five top broker account to find particular of the best bonus also provides readily available. Sure, focus made away from a top-give savings account is generally sensed nonexempt earnings and really should getting claimed once you file the taxes. For those who earn at the very least $10 inside the interest in a twelve months, their lender will likely matter you Function 1099-INT, and that info the degree of attention your received. Extent and you will volume from transform may vary depending on the lender’s rules, race and outside monetary things for instance the Fed’s change so you can its benchmark rates.

- RBC’s eyes is to help customers flourish and you will groups do just fine and that it values is reflected in every our very own strategies and you will choices.

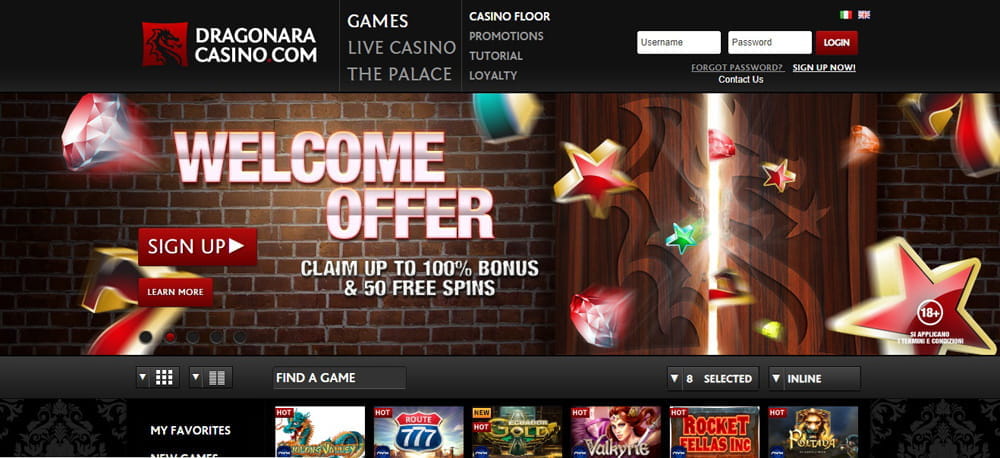

- The newest spins try meant for the fresh Wacky Panda on the web position from Game Global studio.

- Researching the characteristics away from web based casinos necessary with this directory of criteria, i make sure since 2025, those sites are the most useful to possess Canadian participants.

- Thanks to classes, mentorship, and you will availableness, the applying not merely contact the newest quick demands and also paves how to possess a more inclusive and you will strong globe.

- You to definitely massive difference ranging from securities vs. Dvds would be the fact Dvds are a financial tool, when you’re securities is actually replaced.

The new opinions shown inside remarks are the ones of one’s creator and could not at all times mirror the individuals stored because of the Kestra Investment Services, LLC or Kestra Consultative Characteristics, LLC. This really is to own general mr bet casino welcome bonus guidance simply and that is not designed to give specific investment guidance otherwise ideas for any person. It’s advocated that you consult with your financial professional, lawyer, otherwise income tax advisor pertaining to your individual state. Playing with diversification within your funding strategy none assurances nor promises better overall performance and should not lessen loss of dominating due to help you switching industry standards.

In fact, the fresh Fed slashed rates of interest in Sep, November, and December 2024 meetings. The newest Fed’s monetary forecasts indicate that Video game cost you will consistently slip because the much subsequently because the 2027. When you are trying to find an informed Computer game costs to have older people, including, you might want to find Dvds that give finest interest cost for older persons. And if you are searching for planning for retirement, you may want to imagine IRA Cds over antique Cds. Some other disadvantage to financial which have EagleBank would be the fact their mobile financial app has lackluster reviews.

Its lack of a common standard inside durability complicates analysis reliability, therefore we invest greatly inside the converting research to make certain comparability and you can understanding, showing the relevance inside financing procedures. Getting a taxation reimburse each year away from many — if you don’t plenty — from bucks may seem nice, nevertheless will be using that money and growing their money. If you’re making a decent amount of money yet , refuge’t been worried about making the most of your finances, it’s time and energy to meet up a game title plan. The new CDIC talks about qualified dumps during the its member institutions to have right up to help you $a hundred,100000 (as well as dominating and interest) for each and every covered deposit category. Because of the integrating which have several CDIC players (unlike being one our selves) we’re in a position to combine such pros and you can give you better comfort away from mind.

From the CasinosHunter, my personal team merely advises $step 1 deposit gambling enterprises one to see our top quality conditions. Axos Personal Buyer Financial’sinsured dollars sweep program develops your Government Put Insurance coverage Company (FDIC) coverage around $240 million in the deposits. Subscribers take pleasure in white-glove services, no financial fees, high transaction restrictions, free domestic and you will worldwide cables, investment professionals, and you may amenities for example VIP availableness in the over 1,two hundred airport lounges international. You’ll need to take care of the very least balance away from $250,100 so you can qualify for Personal Consumer Financial. Computer game ladders can help decrease the chance which you’ll need to withdraw your fund until the CD’s name size are upwards. That said, Cds won’t get you as frequently cash on average while the investment manage.

FinServ has influenced over 500 pupils by the partnering with well over 40 Universities and colleges. Dependent inside 2019, FinServ Base try a 501(c)(3) planning to solve the fresh talent and you can advancement drama inside the finanical characteristics. This current year, we’ve concerned about structuring our experienced and enchanting Individual Consumer teams to help you finest serve all of our step 3,000+ UHNW and you may HNW subscribers when you are improving the team’s every day operations and you will occupation development. We are going to consistently control all of our global community – a major international collaboration of separate, robust companies which can be experts in the part. Our people give regional degree and you may think leaders on the giving to help you their regions and you will work together around discover the brand new a way to increase get across-border providing.

Has just, we rented a few the new devoted SII associates to add to all of us, and all of our first Climate Alter Using Expert, and you may set up over 50 “Sustainable and you may Effect Using Professionals” over the firm. With her, it’s got acceptance me to ingrain and you may size work on the all of our key company providing. Which detection is hugely motivating for people and affirms the significance of our own technical so you can advisors and you will donors.

All of our subscribers benefit from a and you will varied enterprize model across the entire financial. In control spending is at one’s heart in our design and also at the center of our customers’ questions and you can takes on a crucial role regarding the changeover of our own economic climates to an even more green design. I are nevertheless purchased support and you may suggest our very own clients, advertisers, and multi-generational families within this techniques, consolidating the options with this customers’ determine and their need to deal with green innovation pressures.